Property taxes vary from state to state, and even between counties within a state. Even the way they calculate the property tax can differ. Some calculate it as a rate of the market value, while others calculate it on the assessment ratio of the property. Ultimately, it can be thought of as a percentage of the property value.

As people are thinking about moving to a different states, it's important to keep in mind how much property tax you'll be paying if you'd like to settle down and buy a home.

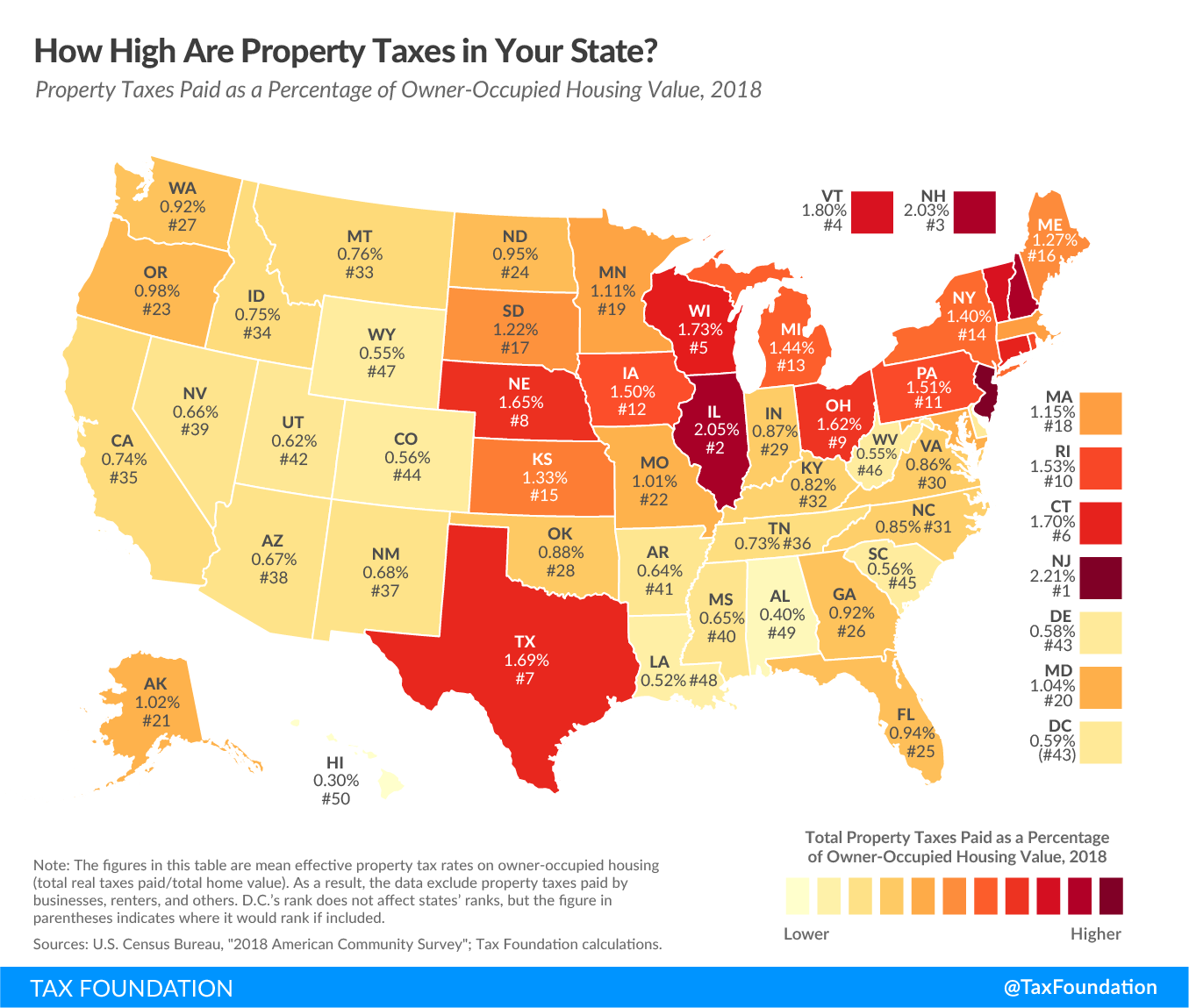

Tax Foundation, a non-profit, shared its findings of the average effective tax rate of states across the nation.

(Source: taxfoundation.org)

The highest effective tax rate is in New Jersey at 2.21%, followed by Illinois, New Hampshire, Vermont and Wisconsin.

| Rank | State | Effective Tax Rate |

|---|---|---|

| 1 | New Jersey | 2.21% |

| 2 | Illionois | 2.05% |

| 3 | New Hampshire | 2.03% |

| 4 | Vermont | 1.80% |

| 5 | Wisconsin | 1.73% |

| 6 | Conneticut | 1.70% |

| 7 | Texas | 1.69% |

| 8 | Nebraska | 1.65% |

| 9 | Ohio | 1.62% |

| 10 | Rhode Island | 1.53% |

The lowest effective tax rate is Hawaii at 0.30%, followed by Alabama, Louisiana and Wyoming.

| Rank | State | Effective Tax Rate |

|---|---|---|

| 50 | Hawaii | 0.30% |

| 49 | Alabama | 0.40% |

| 48 | Louisiana | 0.52% |

| 47 | Wyoming | 0.55% |

| 46 | West Virginia | 0.55% |

| 45 | South Carolina | 0.56% |

| 44 | Colorado | 0.56% |

| 43 | Delaware | 0.58% |

| 43 | Washington DC | 0.59% |

| 42 | Utah | 0.62% |